Being a first time buyer in 2023 is not a good or easy thing, the house price figures are ridiculous and more and more families are committing to mortgages which will leave them little or no cash for living their lives. This can create a huge amount of pressure on young couples and families alike, especially if you are looking for a mortgage for your first home. 2023 House prices are ridiculous with house prices expected to increase continually through 2023 into 2024. Most people buying a home need to take out a new mortgage or extend an existing mortgage and this can, if not carefully considered and thought through, create huge financial problems in the future. Mortgage Calculations and Mortgage ConsiderationsĪre you thinking of committing to a mortgage? Buying a home is one of the most exciting, times of your life, it is also one of the most stressful. In this article, we look at some steps you need to take before choosing a new mortgage. Getting the best Mortgage Deal: For the average homebuyer, it is hard to distinguish the difference between different mortgages. Irrespective of their income and savings, buying a home requires a lot of financial resources. Understanding Mortgages: For most people, buying a home is one of the biggest investment decisions in their lifetime. If you go out to seek a mortgage, you will see hundreds of mortgage products. Understanding the different types of Mortgage: For most people, getting a mortgage is one of the most important financial decisions in their lives. To minimize their risk, lenders perform a detailed analysis on the income and expenses of the borrower. Understanding Mortgage Lenders: Mortgage lenders take several factors into account before deciding how much they would lend to borrowers.

#225k house mortgage calculator how to

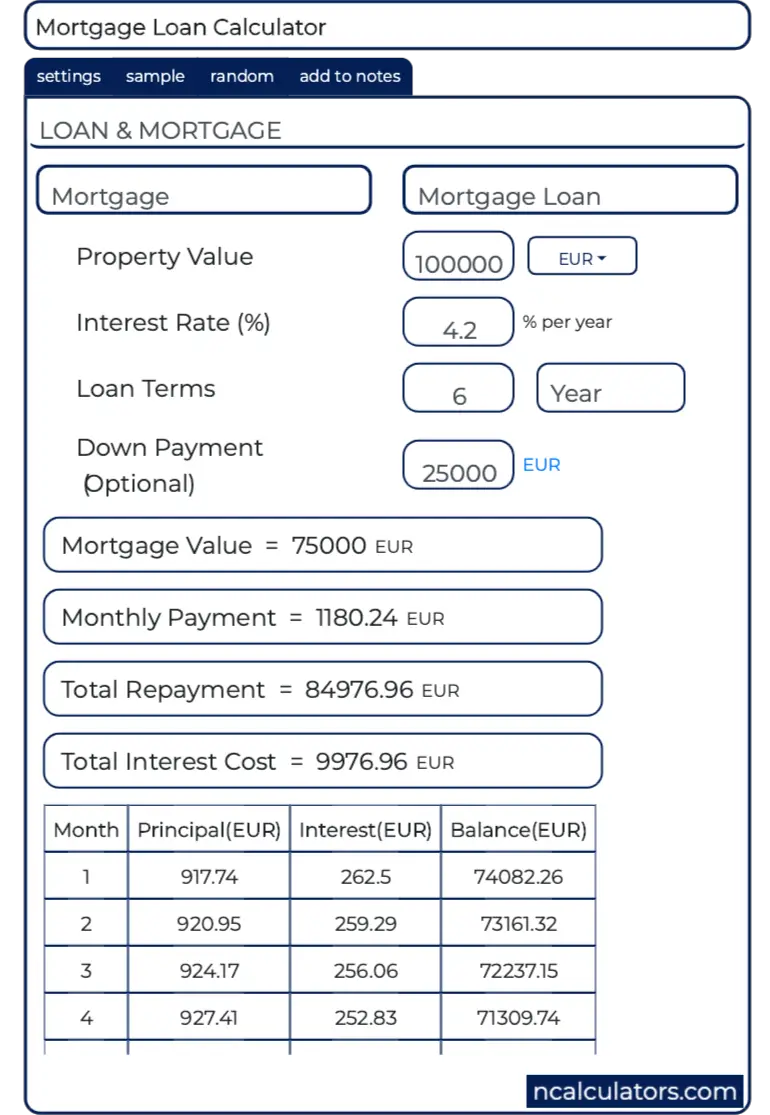

Mortgages and Budgeting: How to prepare for a Mortgage Mortgage affordability and mortgage comparison review from an Independent Mortgage Adviser: Using an Independent Mortgage Adviser will saves you time and stress and affordability calculations and mortgage comparison can be completed centrally on your behalf. This means that during the repayment of your mortgage, you will repay a whopping £ in interest to your mortgage provider, and do they ever call on your birthday? Mortgage Guides Mortgage Calculation for £ MortgageĪ mortgage for £ repaid over years will cost you £ per calendar month and cost you a total of £. Use a mortgage broker which doesn't charge you fees, so you get the best mortgage deals without the hassle. Using an Independent Mortgage Advisor will saves you time and stress and affordability calculations and mortgage comparison can be completed centrally on your behalf. We also provide regular mortgage updates, guides and mortgage news so you can make the right financial decision when choosing a mortgage. 40% Deposit Calculation for a £ 225,000.00 Mortgageĭid you know that we review the UK's leading mortgage providers each month and produce a comparative guide to the best mortgage deals? By collating the latest mortgage deals from each provider, we save you the time and effort of looking for and finding the best mortgage deals.35% Deposit Calculation for a £ 225,000.00 Mortgage.30% Deposit Calculation for a £ 225,000.00 Mortgage.25% Deposit Calculation for a £ 225,000.00 Mortgage.20% Deposit Calculation for a £ 225,000.00 Mortgage.15% Deposit Calculation for a £ 225,000.00 Mortgage.10% Deposit Calculation for a £ 225,000.00 Mortgage.5% Deposit Calculation for a £ 225,000.00 Mortgage.

See how much it will cost you to move home when buying a property worth £ 225,000.00ĭo you need to calculate how much deposit you will need for a £ 225,000.00 Mortgage? Try our new Mortgage Deposit Calculator or quick on a deposit percentage below to see an illustration that you can tweak to suit your circumstances Is the big question, can your finances cover the cost of a £ 225,000.00 Mortgage? Are you sure you have considered all the costs? If you are increasingly answering 'yes' then it's worth doing the final financial checks, review your monthly household budget (so you are ready to answer all the questions the mortgage advisor will ask and check that you have the deposit covered.

0 kommentar(er)

0 kommentar(er)